The sale of gluten free products has increased globally in the past decade. Until recently, gluten free products went practically unnoticed with the exception of speciality health food stores that were selling gluten free (GF) products. Currently, GF products are now a feature in all major supermarkets, local stores and online shopping. This article considers where trends are going and how NPD will respond to them.

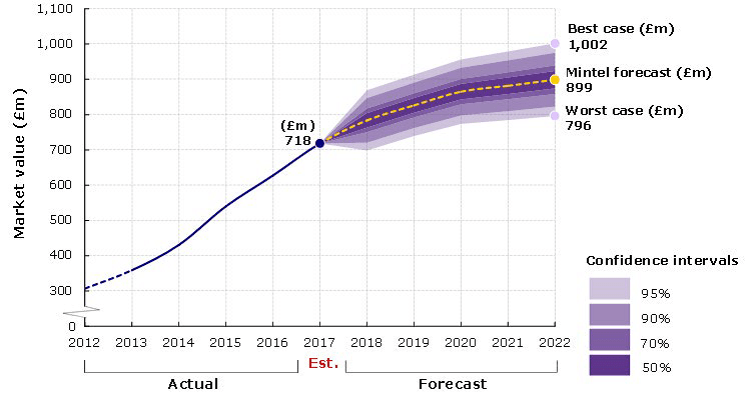

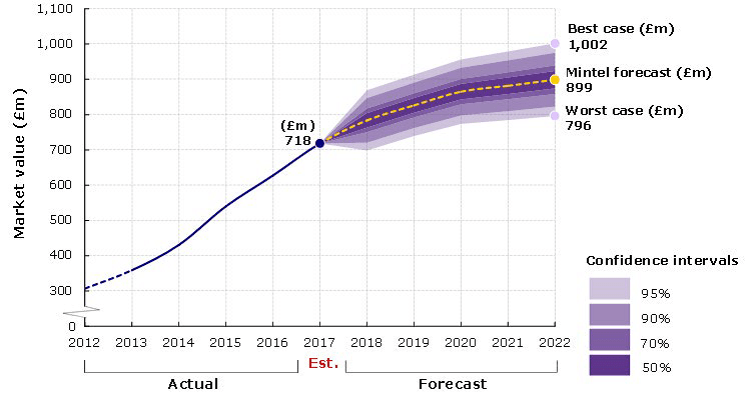

Recent research in the UK has shown a marked increase in the consumption of gluten free products. This has been attributed to the improved diagnosis of coeliac disease which has seen a rise from 24% in 2011 to 30% in 2015 (See Coeliac UK). Furthermore, there has been an increase in people without coeliac disease avoiding products that contain gluten, hence the increase in volume and value of GF products at a rapid rate (See research paper here) . The upturn has been credited to consumption of GF products as part of a healthy lifestyle as opposed to dietary restrictions and has seen retail value sales of GF products on the rise in terms of market value and range of free-from products (see, Figure 1).

Source: Based on IRI/Mintel

Figure 1, UK retail value sales of free-from food and drink with projections, 2012-2022 (See Mintel)

The trends and analysis – health or lifestyle; it is now a trend rather than a fad with more people using and consuming GF products. Health has had a major influence on the GF category with approximately 48% of people consuming the products for general health reasons such as helping with weight loss or because they see GF products as healthier options than standard consumer products (See research paper here),. This rise has prompted various FMCG companies to incorporate GF products in their manufacturing plan so as to ensure they maintain a competitive edge and are able to meet discerning consumer needs.

“Estimated at £718 million in 2017, the UK free-from market more than doubled its size over 2012-17. This was due mainly to an increase in volume sales, driven by a number of factors including media buzz and increased distribution.” (See Mintel)

Young adults between the ages of 20-29 years are expected to seek products that promote wellness, transparency and sustainability. This has contributed to the sharp rise in consumption of GF products by young adults who value nutrition, health benefits and dietary intake. This age group has often shown a preference in pursuing a lifestyle that is mostly moderated and focused on product integrity and sustainability (See research paper here). New products under the GF category have hit the consumer market and investment in food research and product development has drastically increased. GF products have become a mainstream sensation and have been embraced out of necessity and as a personal choice towards achieving a healthy lifestyle. However, the benefits of going GF are still not entirely clear with nutritional concerns being raised due to iron, calcium and fibre deficiencies (See research paper here).

Food product development; in order to mitigate issues concerning the various deficiencies, food manufacturers are now blending more grains such as quinoa and amaranth into the various products to increase the nutrition value in GF products. Additionally, research into new product development at the National Centre for Food Manufacturing (NCFM) is focused on fortifying GF flours with freeze dried or dehydrated vegetables. We are developing recipes and products that offer personalised dietary needs and meet consumer expectations.

Socials – ‘Media Buzz’; the social media platform has given an increasingly important voice where the ability to communicate developments using interactive perspectives for consumers has had an impact. The growth of software applications (e.g. mobile ‘apps’) has probably enhanced the rapid rise in sales of GF products with those such as ‘Gluten free food checker’ and ‘Gluten free on the move’. These are tested and provide information to consumers on-the-go making their shopping experience easier and much more efficient (See, Coeliac UK).

The regulatory space; the Food Information for Consumer regulation (EU) No 1169/2011 has a role in increasing consumer awareness of ingredients used in producing gluten free products through the prerequisite labelling regulation on food products (See research paper here). Further studies by nutritionists and dietitians will now investigate the underlying reasons for the shift in consumer preference for gluten-free products along with other issues such wider well-being and weight management.

The Nutrition and NPD Innovations series; the whole GF arena is of specific interest to Food Insights and sustainability programmes at NCFM and we are delivering our first Nutrition and NPD Innovations Breakfast seminar on 20th November 2018, it would be great to see you there if you can get there!